Walmart versus Amazon: US giants vie for retail media.

Walmart is leveraging the behaviour of 144 million consumers to refine its media offering, launching a new platform and expanding its network to thousands of brands, not just its suppliers. For the first time, Walmart is integrating its data assets—through the Luminate analytics tool, which provides suppliers with data on sales, supply chain, and purchasing behaviour—with the Walmart Connect retail media platform, managing an extensive network of physical and digital advertising space. The target audience is immense: 90% of US households shop at Walmart annually, and more than 140 million customers visit its 10,000 stores and e-commerce sites each week, with online transactions making up 6.4% of all US online transactions. The defining factor will be the complexity and efficiency of this advertising network.

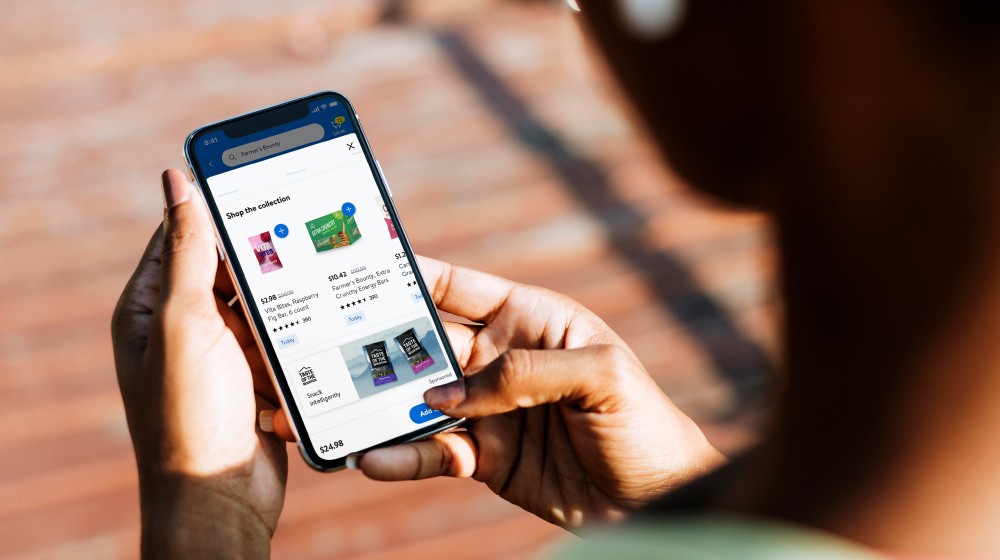

A retail media network (RMN) encompasses the entire array of physical and digital touchpoints a retailer has at its disposal, including point-of-sale, out-of-home (OOH) advertising, flyers, e-commerce, apps, newsletters, and wallets. The novelty of these strategic assets lies not only in the firepower of the media ecosystem but also in the full and legitimate control of the data at the owner’s disposal. As Nikhil Raj, partner at Walmart and co-founder of its RMN, states, “Retailers have realised that they have outsourced key relationships, such as advertising sales, and over the next three to five years they will bring them back in-house.” Essentially, customer loyalty built by retailers becomes an asset that can be sold (or rather, rented).

Amazon, a pure player holding more than a third (37.6%) of the entire US online sales share, bases its business model on retail media but controls it predominantly in the digital landscape. Walmart, on the other hand, has emerged as a laboratory-company that, thanks to its investment capabilities and a well-organised sales network, has substantially innovated offline sales tracking methods over the last fifteen years. While e-commerce and social media were experimenting with tracking pixels, Walmart was exploring ways to test the effectiveness of advertising in relation to in-store sales.

Walmart’s RMN brings together its data assets—via the Luminate analytics tool, providing suppliers with insights on sales, supply chain, and purchasing behaviour—and the Walmart Connect retail media platform, managing a vast network of physical and digital advertising spaces. This integration allows Walmart to target an immense audience: annually, 90% of US households shop at Walmart, with over 140 million customers visiting its 10,000 stores and e-commerce sites each week, accounting for 6.4% of all US online transactions. The key differentiator will be the complexity and efficiency of this advertising network.

Walmart is working hard to challenge Amazon on the retail media terrain, and a key element to watch is how it is targeting those brands that traditionally relied on online searches, inviting them to diversify through in-app and in-store visibility. With the new Walmart Luminate Insights Activation tool, Walmart’s partners already communicating through its media will be able to leverage Luminate data to set their own campaigns. Those already routinely using Luminate to support sales strategies will also be able to build their Walmart Connect media strategies based on the same data. For Seth Dallaire, Executive Vice President and CRO of Walmart US, “Walmart Connect is already known for its advanced targeting and measurement resources. Now we can identify target segments that buy less (or less often), analyse their characteristics, and deliver targeted communication.”

The challenge also extends to the realm of advertisers. Walmart will expand the service well beyond its supplier network to include brands outside the store’s own offerings but “complementary,” primarily from the tourism, automotive, financial services, entertainment, and restaurant sectors. These brands will have space in offsite media, particularly on social media. “The important thing is that they are valuable brands for our customers,” reports the company, “that they help them save money and live better.” In onsite, proprietary media, communication is extended to brands of all sizes, including those selling through marketplaces, which today account for a significant part of Amazon’s turnover. As far as content is concerned, Walmart’s partners will also be able to use a machine-learning-based tool for the automated production and optimisation of advertising creativity, with reporting on the performance of the campaigns launched.